How to Analyse Real Estate Market in India & Understand the Market Trends

The ever-evolving real estate market in India is riddled with opportunities and challenges that homebuyers need to navigate efficiently. In this blog, we aim to provide you with essential insights and tools for making well-informed decisions by effectively analysing the real estate trends.

From first-time buyers to seasoned investors, understanding the real estate market trends is the key to turning real estate ventures into successful investments. This guide will shed light on the key factors affecting the real estate market in India, and provide practical steps to analyze the market efficiently.

Whether you’re curious about how the real estate market operates, or want to know the growth of the real estate sector, and future of the real estate industry in India, this guide has got you covered. Let’s dive in and unravel the complexities of the real estate market.

Also Read: How to Determine the Market Value of a Property

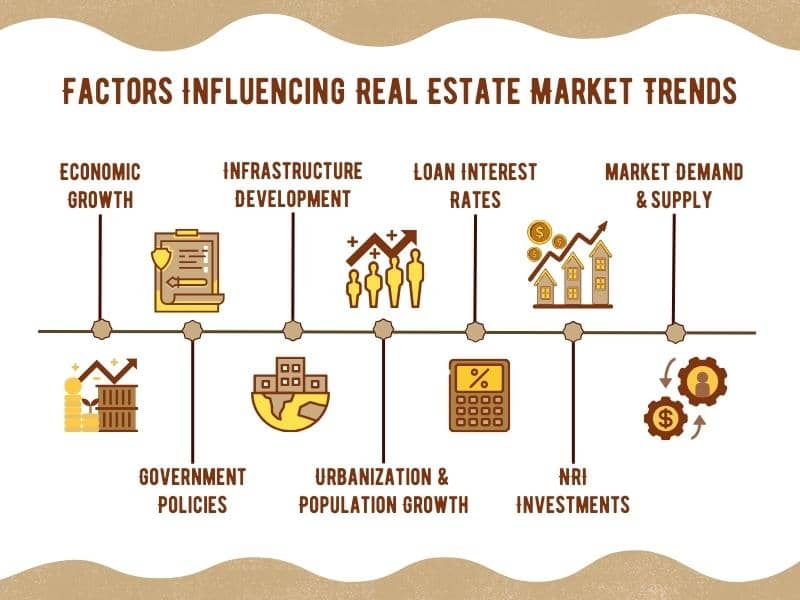

Factors Affecting Real Estate Market in India

The Indian real estate sector is complex and influenced by a multitude of factors. Understanding these factors can help investors, homebuyers, and real estate professionals make informed decisions. Here's a rundown of some of the important aspects shaping our country's real estate sector market trends:

a. Economic Growth

Economic growth is a significant driver of the real estate market. When the economy is thriving, people have more disposable income, which often leads to housing sales and increased demand for property.

Conversely, in economic downturns, the real estate market tends to stagnate or decline as people are less likely to make big investments.

b. Government Policies and Regulations

Government policies and regulations play a crucial role in the Indian real estate market. For instance, policies such as the Real Estate Regulation Act (RERA), which was implemented to bring transparency and accountability to the industry, have had a significant impact on market trends.

Other initiatives such as the Pradhan Mantri Awas Yojana, aimed at providing affordable housing, also influence market dynamics.

c. Infrastructure Development

The development of infrastructure, such as roads, metro systems, airports, and utilities, has a direct impact on real estate prices and trends and can result in rising household income through property renting.

Areas that see new infrastructure development attributes to the rising number of residential and commercial projects due to enhanced connectivity and amenities.

d. Urbanization and Population Growth

Rapid urbanization and population growth leads to an increased housing demand in the global real estate market, especially in urban areas.

This demand is not just for residential properties but also for commercial spaces as more businesses are established to cater to the growing population.

e. Interest Rates

Interest rates set by the Reserve Bank of India (RBI), called the Base Rate, can significantly influence the real estate market.

Lower interest rates make home loans more affordable, which can lead to increased demand for properties. Conversely, higher interest rates can dampen the demand as the cost of borrowing rises.

f. Investment from NRIs

Non Resident Indian (NRI) are a significant source of investment in the Indian real estate market.

Changes in the global economy, as well as regulations pertaining to NRI investments, can influence the amount of foreign investment flowing into the India real estate market.

g. Property Supply and Demand

The basic economic principle of supply and demand plays a significant role in the real estate market.

If there is an oversupply of properties but not enough demand, prices may drop. Conversely, if demand is high but supply is limited, prices are likely to rise.

Also read: The Complete Guide to Buy a House

How to Do a Real Estate Market Analysis?

The process of analyzing the market is crucial for potential homebuyers because it enables you to make decisions based on factual data and trends, rather than merely following your intuition.

Real estate market analysis involves examining an area's real estate market, considering various elements such as property prices, the community's demographics, and local amenities. It provides a snapshot of current conditions, future predictions, and investment opportunities.

A comprehensive real estate market analysis comprises several key components:

Step 1: Define Your Objectives

Your goals will dictate the type of data you need to collect. Whether it's for investment or personal use, having clear objectives helps guide your research and analysis.

Think about whether you are looking for a home to live in, or are you planning to invest and earn returns through rental income from a commercial office space or property appreciation.

Note: If you are planning for property investment, understand the difference between long-term and short-term investments, and how each type of investment aligns with your goals.

Step 2: Collect Data about the Property

Gather all the data about the property like its size, age, condition, and any unique features, property prices, demographics, amenities, etc., which are critical to your analysis.

You can find this information on several online resources and local real estate agents. Research thoroughly and validate all information before making any decisions.

Step 3: Gather Info about the Neighbourhood

Also get as much information about the neighborhood and community as possible, like the nearby amenities, schools, crime rate, and future development plans.

If you're planning to rent out the property which you are looking to invest in, understanding the rental market and factors influencing them is crucial to predict the possible ROI.

Step 4: Do a Comparative Analysis

Look for similar properties in the same area which were either sold or put on the market recently. Note their sale prices, the property features, time on the market, and other essential details.

This helps you understand the ongoing market trend and analyse whether a particular property is overpriced or underpriced when you are planning to make an investment.

Step 5: Analyze the Market Trends

Understand the market dynamics, property supply and demand in your target locality and the local real estate market conditions. Look for patterns in the property price trends, investment trends, and other market indicators that can help predict future market behavior, providing you an advantage in decision-making.

For example, if the area is booming with job opportunities, there may be construction development in the near future and an increased demand for housing.

Step 6: Risks Analysis and Mitigation

Every investment comes with risks. Identifying potential risks associated with your property investment and developing strategies to reduce them is vital.

You can consult a professional real estate agent or broker to understand the possible risks you may face upon investing in the particular property.

Note: Be aware of zoning laws, property taxes, and other regulations that may affect your investment.

Also Read: Learn the Different Property Laws in Real Estate

Significance of Analysing Real Estate Market Trends

Real estate market trends play an indispensable role in the decision-making process of buyers, sellers, and investors.

By understanding these trends, individuals and entities can make informed choices, mitigate risks, and maximize returns on investment. A few reasons for assessing the real estate industry before buying a property include:

#1 Helps in Informed Decision Making

Understanding market trends allows investors and buyers to make decisions based on data rather than speculation.

For instance, if there is a trend of increasing property prices in a particular area, a buyer might decide to invest earlier. Conversely, if the market shows signs of cooling down, a buyer might wait for more favorable conditions.

#2 Easy Identification of Investment Opportunities

Real estate market trends can help identify emerging investment opportunities. An area experiencing substantial growth, rapid infrastructure development or an influx of businesses might show signs of becoming a real estate hotspot.

Investors who can identify these trends early can capitalize by investing in properties having a potential for significant appreciation.

#3 Risk Analysis & Mitigation

Real estate investments come with inherent risks. However, understanding market trends can help in mitigating these risks.

For instance, if there is a consistent decline in property prices in a particular area due to economic factors, investors might consider diversifying their investments to include properties in different locations or even different types of real estate, such as commercial properties instead of residential.

#4 Understanding the Market Supply & Demand

Market trends provide insights into supply and demand dynamics. For example, in an area with high rental demand but low supply, there might be opportunities to invest in rental properties. On the other hand, in an area with an oversupply of properties, prices might be more negotiable.

#5 Analysing the Rental Yield

For investors interested in generating rental income, understanding rental market trends is crucial. Rental yields, the ratio of annual rental income to the property price, can vary significantly depending on market trends.

Knowing the rental yields in different areas allows investors to allocate their resources more efficiently and to focus on properties with the highest potential rental income.

#6 Timing the Sale/Purchase of a Property

While it is difficult to perfectly time the real estate market, understanding market trends can help in making educated guesses on the best times to buy or sell.

For example, selling a property during a seller’s market, when demand is high and inventory is low, could yield higher returns compared to selling during a buyer’s market.

#7 Long-term Strategic Planning

For long-term investors, understanding market trends is vital for strategic planning.

Knowing how different markets have performed historically, and what factors have influenced these trends, can help investors make predictions about future performance and plan their investments accordingly.

#8 Negotiation Leverage

Being knowledgeable about market trends provides negotiation leverage. A buyer who is aware that they are in a buyer's market might negotiate more aggressively, while a seller in a seller's market might price their property more assertively. Hone your negotiation skills to ensure you get the best deal possible.

Also read: How to Negotiate Property Prices Like a Pro

Tools and Resources for Real Estate Industry Analysis

Analyzing market trends and conditions is essential for making informed business or investment decisions. Here are some tools and resources that are widely used for market analysis:

-

Property Listing Websites: Utilize platforms like 99acres, MagicBricks, and Housing.com to view property listings, compare prices, and observe trends in various locations.

-

Real Estate Research Reports: Refer to in-depth research reports published by organizations such as JLL India, Knight Frank India, and CBRE for market analysis and future projections.

-

RERA Websites: Check state-specific RERA websites for information on registered projects, developer details, and legal compliances.

-

Real Estate Market News Portals: Stay updated on the latest market trends, policy changes, and news through portals like Livemint, Economic Times Real Estate, and Realty Fact.

-

Social Media and Forums: Engage in networking and discussions on platforms like LinkedIn, Twitter, and Indian Real Estate Forum (IREF) to gather insights from industry professionals.

-

Google Trends: Monitor the popularity of real estate-related search terms over time and across regions to gauge market interest.

-

Professional Consultation: Seek advice from real estate agents, brokers, and experts familiar with local markets for insights that may not be easily available through other sources.

Also Read: What to Ask Real Estate Agents before Purchasing a Home

Analysis of the Current Real Estate Sector in India

-

Market Recovery Post-Pandemic: After the initial setback caused by the COVID-19 pandemic, the real estate sector in India has been showing signs of recovery, with an increase in residential property sales and new project launches.

-

Affordable Housing Surge: There is a growing real estate demand for affordable housing, fueled by government schemes and the emerging middle class. Developers are increasingly focusing on this segment.

-

Commercial Real Estate Shifts: The rise of remote working has influenced the commercial real estate sector, with a shift towards flexible co-working spaces and a reduction in demand for traditional office spaces.

-

Sustainable Building Practices: There is an increasing awareness of environmental sustainability, leading to a rise in green building practices. Developers are now focusing on energy-efficient systems and sustainable materials.

-

Technological Integration: The integration of technology in the real estate sector, such as virtual tours and digital transactions, is becoming prominent, as it adds convenience and safety to the property buying process.

-

Investments in Tier-II and Tier-III Cities: With urbanization and the development of infrastructure, there is an upward trend in real estate investments in Tier-II and Tier-III cities.

-

Government Initiatives and Regulations: The introduction of regulations like RERA (Real Estate Regulation and Development Act) and GST (Goods and Services Tax) has brought transparency and accountability to the sector. Government initiatives like “Housing for All” are also impacting the market positively.

-

Foreign Investments: The Indian real estate sector is attracting foreign investments. The introduction of Real Estate Investment Trusts (REITs) in India provided a new avenue for investments, allowing retail investors to invest in income-generating real estate assets.

-

Rental Market Trends: The rental market is evolving with a rise in demand for rental properties, especially in urban areas where there is a significant population of young professionals.

This analysis provides an overview of the current scenario in the Indian real estate sector, which is vital for investors and homebuyers in making informed decisions.

What is the Real Estate Future in India?

The real estate market in India is one of the most active and rapidly expanding in the world. The unanticipated issues caused by the pandemic between 2020-22 brought about drastic change in the real estate sector that ushered in various hurdles.

However, because of the ongoing rapid urbanisation in metropolitan cities, growth of India's middle class, infrastructure development, increase in investments by NRIs, Government incentives and tax reductions, and integrated living with modern state-of-the-art amenities, there will likely be a sales of approx. $1 trillion of real estate by the year 2030 and will contribute around 10-15% to the GDP by 2025.

Also Read: Future of Real Estate in India

Understanding real estate market trends in India is an indispensable asset for any homebuyer. It empowers you to make informed decisions, recognize valuable investment opportunities, mitigate risks, and negotiate effectively.

From interpreting the macro and micro-economic factors affecting the real estate market, to using a plethora of tools like property listing websites, government data, and professional consultations, new homebuyers can navigate the often complex terrain of the real estate sector.

The Indian real estate market, in particular, is in a dynamic phase with the emergence of affordable housing, sustainable building practices, and the rise of co-living spaces. As a homebuyer, an in-depth analysis and understanding of these trends can position you strategically in realizing that home sales is not just a purchase but a wise investment. Equip yourself with knowledge of how to properly analyse the real estate industry and price trends, and step forward confidently in your home buying journey.